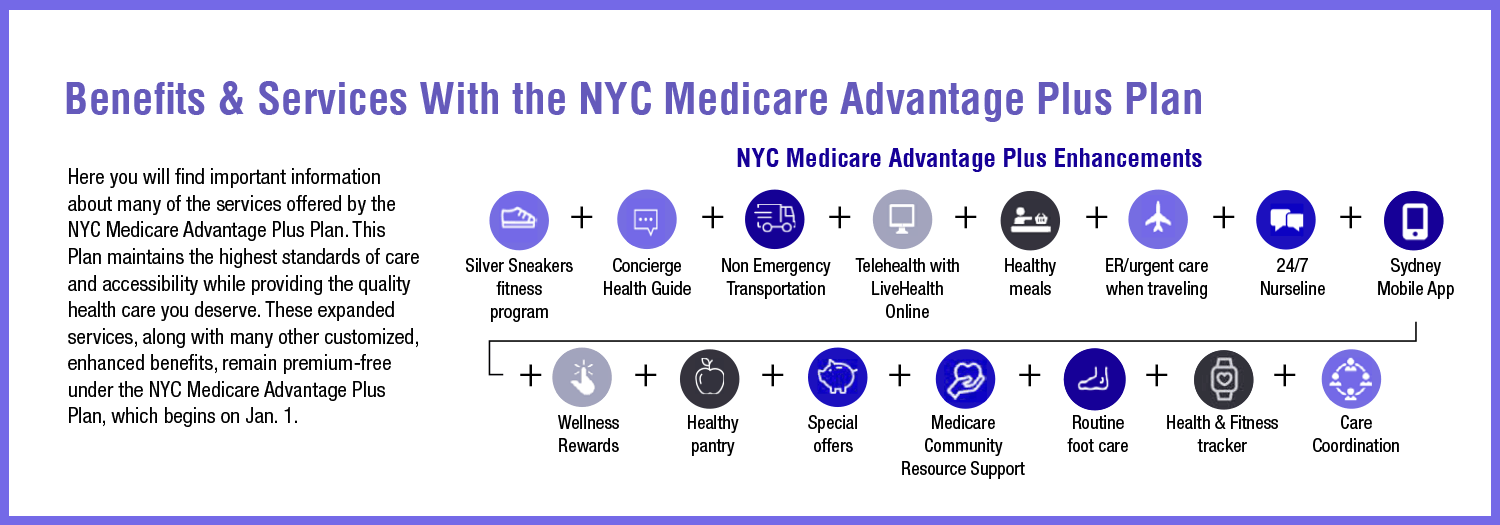

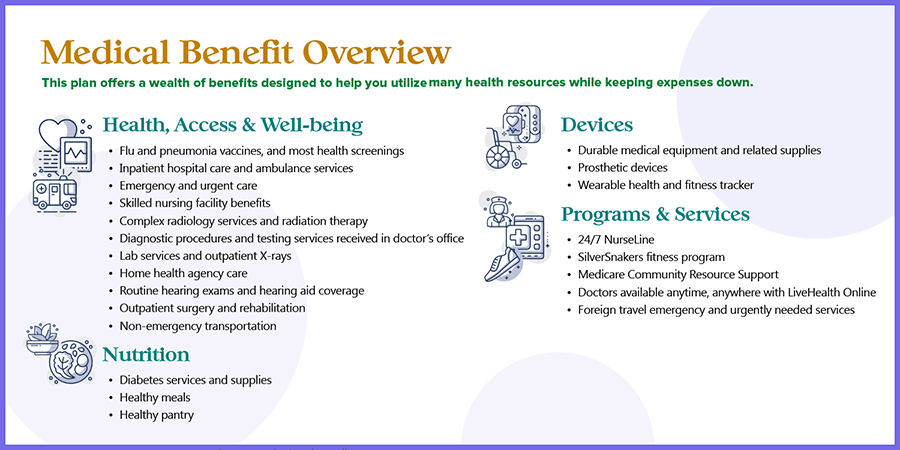

Medical Benefit Overview

This plan offers a wealth of benefits designed to help you utilize many health resources while keeping expenses down.

• Flu and pneumonia vaccines, and most health screenings

• Inpatient hospital care and ambulance services

• Emergency and urgent care

• Skilled nursing facility benefits

• Complex radiology services and radiation therapy

• Diagnostic procedures and testing services received in doctor’s office

• Lab services and outpatient X-rays

• Home health agency care

• Routine hearing exams and hearing aid coverage

• Outpatient surgery and rehabilitation

• Non-emergency transportation

• Diabetes services and supplies

• Healthy meals

• Healthy pantry

• Durable medical equipment and related supplies

• Prosthetic devices

• Wearable health and fitness tracker

• 24/7 NurseLine

• SilverSnakers fitness program

• Medicare Community Resource Support

• Doctors available anytime, anywhere with LiveHealth Online

• Foreign travel emergency and urgently needed services